100 % own property projects

DFK Group, based in Kaltenkirchen near Hamburg, uses investors' capital exclusively to realise property projects for which it is responsible. Our responsibility. Your trust.

Invest with us.

Projects that work for you.

Investment

Your investment instalment flows into the project development of the DFK Group.

Reinvestment

DFK acquires land and residential property, constructs new buildings and renovates existing properties.

Added value letting & sale

The residential properties are sold to investors and let on their behalf as part of the carefree concept.

7 % return participation

Investment contracts secure us decisive competitive advantages, the return on which we share with you.

Secure interest

Flexibly available

No interest rate fluctuations

No speculations

No current fees

With us, no performance or management fees reduce your profits.

Flexible runtime

With us, no performance or management fees reduce your profits.

5 Years

Mortgage of the property

10 Years

Tax-free sale

20 Years

Sale of the property

30 Years

Live on income

DFK Gruppe Kundenerfahrungen

Die Top 4 Gründe:

Warum sich Menschen für uns entscheiden!

Wer nicht mit der DFK zusammenarbeitet, ist selbst Schuld!

Andreas Bitter

Diese Zeit wollte ich nutzen, um meinen Bekannten und Freunden mein Wissen weiterzugeben und die genialen Produkte der DFK vorzustellen.

Tom Schmidt

Wir fühlen uns bei der DFK sehr gut aufgehoben.

Dietrich Gärtner

Hier ist alles schön transparent.

Jedes Jahr erhalte ich eine übersichtliche Aufstellung über mein Vermögen und die Zinsen – dazu wurde und werde ich ausgezeichnet betreut und beraten.

Sergej Fedjaschow

Security rated by third parties

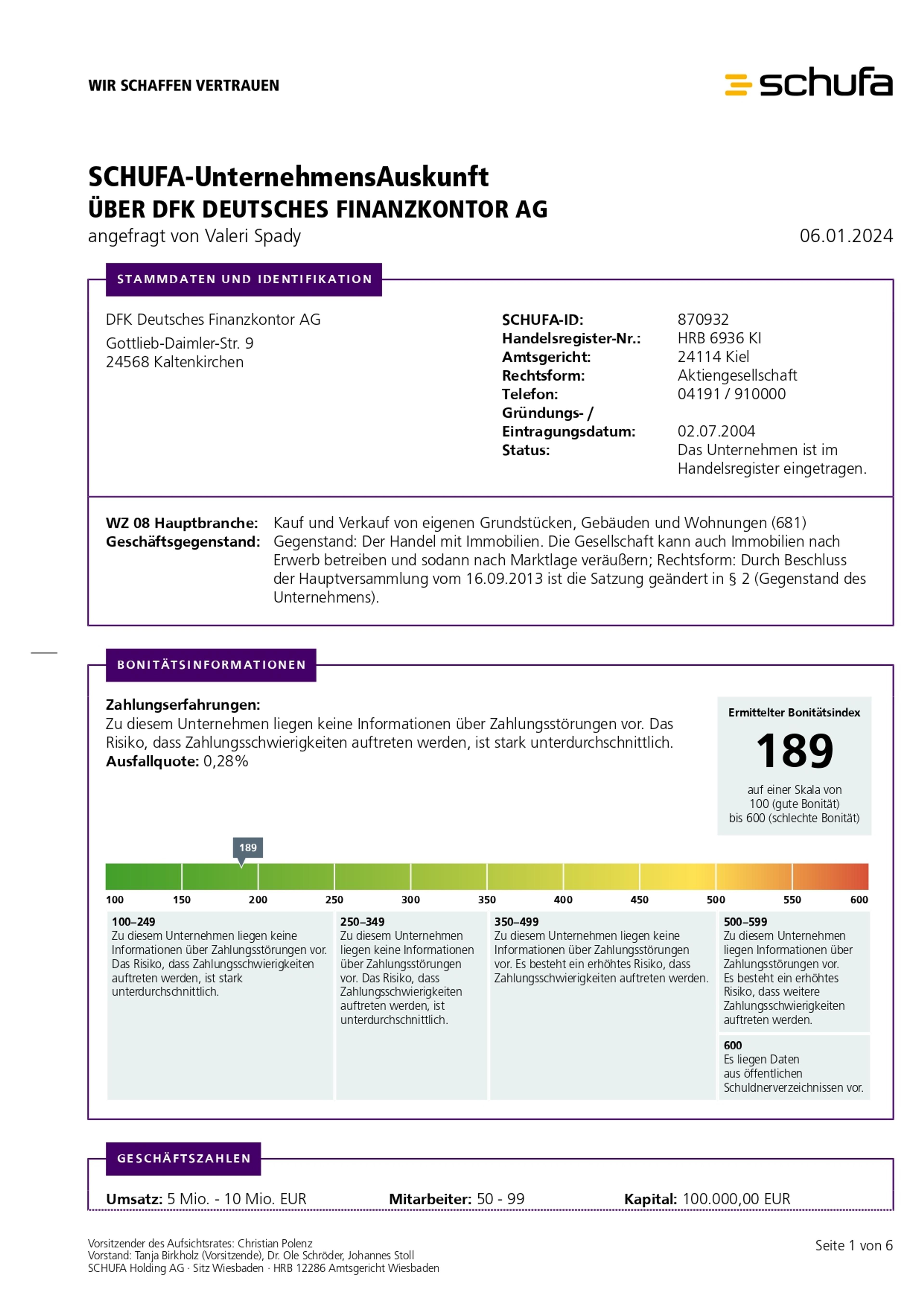

Most people are probably familiar with Schufa as an indicator of the creditworthiness of private individuals. However, Schufa also assesses the creditworthiness of commercial enterprises based on previous experience.

For years, Schufa has consistently certified DFK Deutsches Finanzkontor AG as having a very positive credit rating, based on a minimum probability of default of just 0.28% (2021).

This is what Schufa says: "Payment history: There is no information about payment problems for this company. The risk that payment difficulties will occur is well below average. "Source: Schufa company information about DFK Deutsches Finanzkontor AG, February 2021

Legal notice pursuant to § 12 Abs. 2 VermAnlG:

The acquisition of the investments offered here is associated with considerable risks and can lead to the complete loss of the assets invested.

Frequently asked questions

Property investments are ideal as medium-term investments. Your goal with us should therefore take into account a minimum term of five years. After that, you can opt for a full payout every year, even with a contractually agreed term of 20 years. In addition, the interest is freely available from the first year and can be reinvested or paid out.